With interest rates extraordinarily low (and staying low in the foreseeable future), savings accounts and CDs currently offer paltry returns. According to bankrate.com, the average MMA/Savings APY is currently 1.167%, while a 6-month CD averages 1.294%. My savings account, which used to pay out a 5% APY in 2007, is down to 1.25%.

With interest rates extraordinarily low (and staying low in the foreseeable future), savings accounts and CDs currently offer paltry returns. According to bankrate.com, the average MMA/Savings APY is currently 1.167%, while a 6-month CD averages 1.294%. My savings account, which used to pay out a 5% APY in 2007, is down to 1.25%.Is there any better place to stash your savings?

Experts agree that individuals should have 6-months living expenses saved in a highly liquid form (checking, savings, money market) in case of emergencies (job loss, medical, etc.). In the current economic and job climate, most planners have increased your necessary emergency savings to 9- to 12-months of your living expenses. Walter Updegrave, Money Magazine senior editor, concludes:

Nothing would please me more than to lead you on an excellent adventure during which you could earn much loftier gains on your ten grand than it's getting now in traditional secure savings vehicles like money-market funds, savings accounts and CDs. But I would be misleading you if I told you that I, or anyone else, could pull off such feat. [...] As bad as it may feel to have your everyday savings earning a paltry 1% to 2% in a bank money-market account or short-term CD, it's a lot better than watching the value of your savings plummet because you bought investments that simply weren't designed to hold their value over the short term.

I certainly agree with that assessment, but if you're willing to endure a bit more risk for a portion of your assets, but not enough risk to invest in stocks or stock funds, I think there are some viable alternatives. Still, the largest portion of your liquid emergency fund should remain in checking/savings/money market. For the best rates around the nation and near you, check out the Bank Deals blog. He outlines a weekly summary and rates, highlighting the highest APYs in the nation as seen in this post. At these levels, it's probably not worth considerable effort to chase rates as they change frequently and finding an additional 0.25% isn't worth several hours of your time if it makes banking more difficult in the future. However, if it's an easy transition, then I'd encourage moving your money to an alternative institution.

I am following his advice and have most of my emergency stash in savings and checking. But there is a segment of my portfolio that while I'm not comfortable considering it as part of my long-term growth portfolio (i.e. heavily skewed towards equities), I am okay with taking on a bit more risk to slightly augment my yields. For this, I have turned to federal tax-exempt municipal bonds (muni bonds).

Vanguard has several federal tax-exempt muni bond funds to choose from. In addition, it offers certain funds that are even exempt from state taxes, depending on your state. Typically, shorter-term maturities are lower risk and lower reward, while long-term muni bond funds offer more risk and potential for reward. For example, Vanguard Short-Term Tax Exempt's (VWSTX) best 3-month return in the last five years was 2.07%, while its worst 3-month return was -0.49%. On the other hand, Vanguard Long-Term Tax Exempt's (VWLTX) highest 3-month return was 10.26% and its worst loss was -7.15%. Although these figures may seem high to some observers, Vanguard 500 (VFINX) has figures of +25.85% and -29.64%, respectively. Thus, as you can see, compared to equities, muni bonds (as well as all types of bonds) are less risky (see this chart for a more graphical representation), although still not as safe as a savings account. I cannot emphasize that enough. If you think it's guaranteed to make money, you are wrong. For me, though, this added risk is acceptable for my objectives.

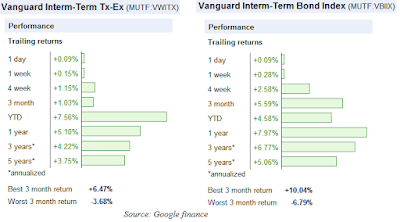

I find tax-free yields especially attractive in this current climate, but one could just as easily consider bond funds that aren't exempt are compare the yields. Let's compare Vanguard Intermediate-Term Tax Exempt (VWITX) with Vanguard Intermediate-Term Bond Index Fund (VBIIX). The figure below compares performance information on these funds without taking tax ramifications into account:

(Click to enlarge)

Note that the muni bond is actually less risky and volatile than the bond index (as evidenced by the betas of 1.46 vs. 0.88 over the last 10 years and the magnitude of the best and worth 3-month returns). With the caveat that the muni bond fund is actually slightly less risky and ignoring the difference in potential performance for now, let's strictly look at yields and see what would be a better deal. VWITX is currently yielding 3.93%, which is exempt from federal taxes (although state taxes still apply), while VBIIX is yielding 4.55%. Assuming that you're in the 25% tax bracket, that 3.93% tax free yield is actually equivalent to 5.24%! That is, the muni bond fund's yield is actually higher when considering the tax ramifications and if you thought both funds would remain stagnant, VWITX would be the better choice by a fairly significant margin. You can calculate it yourself given different tax brackets using the taxable-equivalent yield calculator found here. You're not going to find 5.24% in any savings account or CD rate, that's for sure. Not even close. Although clearly they aren't equivalent investments.

Note that the muni bond is actually less risky and volatile than the bond index (as evidenced by the betas of 1.46 vs. 0.88 over the last 10 years and the magnitude of the best and worth 3-month returns). With the caveat that the muni bond fund is actually slightly less risky and ignoring the difference in potential performance for now, let's strictly look at yields and see what would be a better deal. VWITX is currently yielding 3.93%, which is exempt from federal taxes (although state taxes still apply), while VBIIX is yielding 4.55%. Assuming that you're in the 25% tax bracket, that 3.93% tax free yield is actually equivalent to 5.24%! That is, the muni bond fund's yield is actually higher when considering the tax ramifications and if you thought both funds would remain stagnant, VWITX would be the better choice by a fairly significant margin. You can calculate it yourself given different tax brackets using the taxable-equivalent yield calculator found here. You're not going to find 5.24% in any savings account or CD rate, that's for sure. Not even close. Although clearly they aren't equivalent investments.Since I wanted an investment with the potential for better returns than my current 1.25% APY from my savings account, I have slowly but surely placed money into an intermediate-term municipal bond fund. I started the process in January and the return since then has been nearly 9%. I feel confident that my returns will outperform that of a traditional savings/MMA account. However, I cannot over-emphasize that they aren't equivalent from a liquidity or risk standpoint. The increased risk and reduced liquidity were negative facets that I was willing to take on for the potential for slightly better returns, but every individual must assess his or her own situation on its own. It might not be the proper choice for you and your situation. Or it might make more sense for you to invest in more traditional bonds depending on various factors, but most notably your tax bracket.

I left making this point for the end, but it is quite important. You should never invest in something you don't understand, so if you have no idea what municipal bonds are, don't invest in them. For a primer on municipal bonds and what they are, read this article: "The Basics Of Municipal Bonds."

In the end, there aren't many great places to place your short-term money for reasonable growth. After placing the vast majority of your emergency fund in savings/checking/MMAs, for some individuals it might make sense to check out municipal bonds and muni bond funds. For me, it certainly did.